Ally Financial Overnight Payoff Address: Your Ultimate Guide To Simplify Loan Payments

Looking for the Ally Financial Overnight Payoff Address? You’re in the right place, my friend. Whether you’re trying to pay off your car loan early or need to settle some financial obligations, understanding how Ally Financial handles overnight payments is crucial. Let’s break it down step by step so you can tackle this like a pro.

Let’s face it, navigating loan payments can feel like a maze. From interest rates to due dates, there’s a lot to keep track of. But don’t worry, I’ve got your back. In this article, we’ll dive deep into everything you need to know about the Ally Financial Overnight Payoff Address, including how it works, why it matters, and how to use it effectively.

By the time you finish reading, you’ll have all the tools you need to make informed decisions about your finances. So, grab a cup of coffee, sit back, and let’s get started on this financial journey together!

Read also:Angela Alvarez Only Fans Leak

Here’s a quick overview of what we’ll cover:

- Biography of Ally Financial

- What is Ally Financial Overnight Payoff Address?

- Why Use Ally Financial for Overnight Payments?

- How to Use the Ally Financial Overnight Payoff Address

- Common Questions About Overnight Payoffs

- Tips for Managing Loan Payments

- Is Overnight Payoff Safe?

- Ally Financial vs Other Lenders

- Resources for Financial Management

- Conclusion: Take Control of Your Finances

Biography of Ally Financial

Before we dive into the nitty-gritty of the Ally Financial Overnight Payoff Address, let’s take a moment to understand who Ally Financial is. Founded in 1919 as General Motors Acceptance Corporation (GMAC), Ally Financial has grown into one of the leading financial institutions in the U.S.

They specialize in automotive financing, but they also offer a wide range of financial products, including personal loans, savings accounts, and more. Ally Financial is known for its customer-centric approach, competitive interest rates, and innovative digital solutions.

Key Facts About Ally Financial

Here’s a quick look at some important details about Ally Financial:

| Company Name | Ally Financial Inc. |

|---|---|

| Founded | 1919 |

| Headquarters | Detroit, Michigan, USA |

| Products Offered | Auto loans, personal loans, savings accounts, credit cards |

| Revenue (2022) | $10.6 billion |

What is Ally Financial Overnight Payoff Address?

So, what exactly is the Ally Financial Overnight Payoff Address? Simply put, it’s the address you need to send your payment to if you want to pay off your loan quickly. This service is designed for customers who need to settle their loans fast, often for reasons like selling a car or refinancing.

Using the overnight payoff option ensures that your payment is processed promptly, usually within 24 hours. This can save you time and money by avoiding late fees or additional interest charges.

Read also:Shannon Sharpe Video Leak

Why Overnight Payoff Matters

Here’s why the Ally Financial Overnight Payoff Address is important:

- Speed: Get your loan paid off faster than traditional payment methods.

- Convenience: No need to visit a branch; everything can be done via mail or online.

- Peace of Mind: Knowing your payment will be processed quickly can reduce stress.

Why Use Ally Financial for Overnight Payments?

There are several reasons why Ally Financial stands out when it comes to overnight payoff services. First, they offer competitive rates and flexible terms, making it easier for customers to manage their loans. Second, their digital platform is user-friendly, allowing you to access all the information you need with just a few clicks.

Additionally, Ally Financial has a strong reputation for customer service. If you ever have questions or run into issues, their support team is ready to help. Plus, their transparency about fees and processes makes the whole experience smoother.

Benefits of Using Ally Financial

- Competitive interest rates

- Flexible repayment options

- 24/7 customer support

- Secure and reliable payment methods

How to Use the Ally Financial Overnight Payoff Address

Alright, let’s get practical. Here’s how you can use the Ally Financial Overnight Payoff Address to pay off your loan:

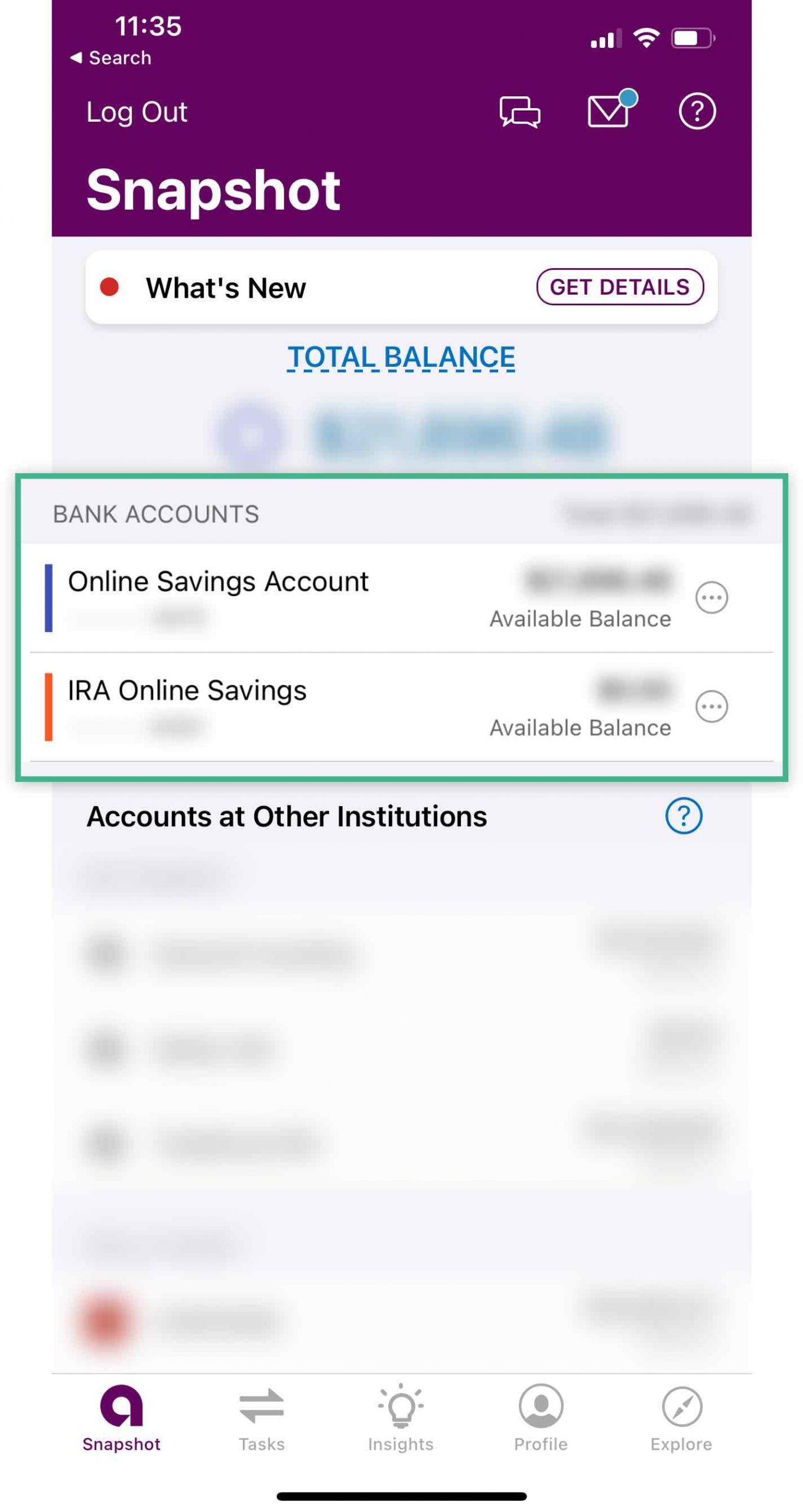

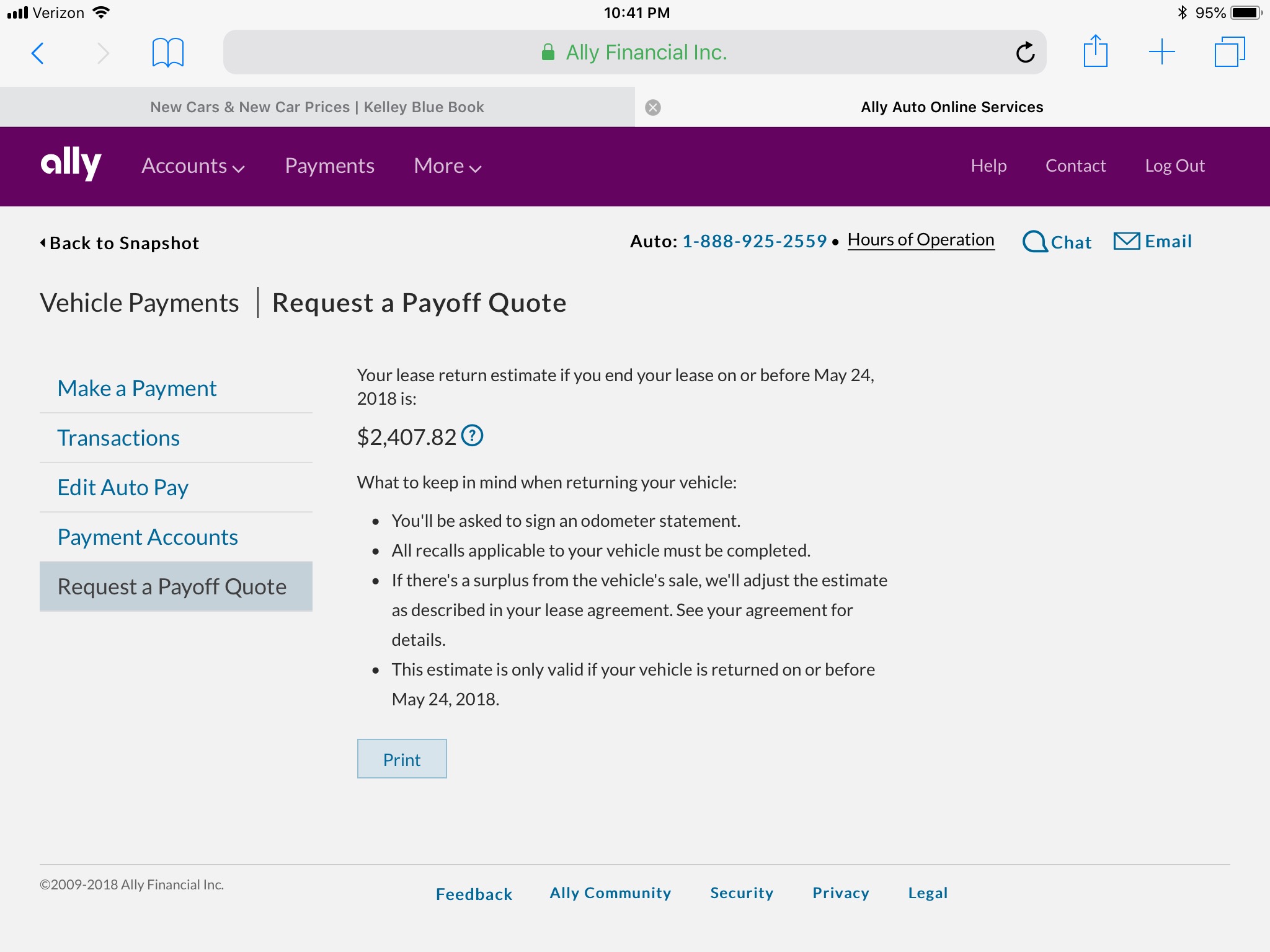

- Log in to your Ally Financial account and request a payoff quote.

- Double-check the amount to ensure it’s accurate.

- Prepare your payment method (check, money order, or wire transfer).

- Mail your payment to the overnight payoff address provided by Ally Financial.

- Keep a record of your transaction for future reference.

Remember, timing is key. If you’re planning to sell your car or refinance, make sure to initiate the payoff process well in advance to avoid any delays.

Important Tips for Overnight Payments

- Always verify the payoff amount before sending your payment.

- Use certified mail or a tracking service to ensure your payment arrives safely.

- Keep copies of all documents and correspondence related to the payoff process.

Common Questions About Overnight Payoffs

Let’s address some frequently asked questions about the Ally Financial Overnight Payoff Address:

Can I Pay Off My Loan Early Without Penalties?

Yes, Ally Financial does not charge prepayment penalties for most of its loans. However, it’s always a good idea to confirm this with your specific loan agreement.

How Long Does It Take for an Overnight Payoff to Process?

Typically, overnight payments are processed within 24 hours. However, processing times may vary depending on the method of payment and the time of day it’s sent.

What Happens After I Pay Off My Loan?

Once your loan is paid off, Ally Financial will send you a lien release document. This document is important if you’re selling your car or refinancing, as it proves the loan has been settled.

Tips for Managing Loan Payments

Managing loan payments doesn’t have to be stressful. Here are a few tips to help you stay on top of things:

- Set up automatic payments to avoid missed deadlines.

- Create a budget that includes your monthly loan payments.

- Regularly review your loan statements for accuracy.

- Consider refinancing if you find better rates elsewhere.

Staying Organized

Keeping track of your payments and documents is crucial. Use digital tools like spreadsheets or financial apps to organize your information. This way, you’ll always know where you stand financially.

Is Overnight Payoff Safe?

Absolutely. Ally Financial is a trusted financial institution with robust security measures in place to protect your information and payments. When using the overnight payoff service, make sure to follow best practices:

- Only use secure payment methods like certified checks or wire transfers.

- Double-check the address before sending your payment.

- Monitor your account for any suspicious activity.

Protecting Yourself

Stay vigilant and report any unusual activity to Ally Financial immediately. Their customer service team is always ready to assist you with any concerns.

Ally Financial vs Other Lenders

When comparing Ally Financial to other lenders, it’s important to consider factors like interest rates, fees, and customer service. Ally Financial often comes out on top due to its competitive rates and ease of use.

However, every borrower’s needs are different. Take the time to research and compare multiple lenders to find the best fit for your financial situation.

What Sets Ally Financial Apart?

- Transparent fee structure

- Customer-centric approach

- Wide range of financial products

- Strong digital presence

Resources for Financial Management

Managing your finances doesn’t have to be overwhelming. Here are some resources to help you along the way:

Conclusion: Take Control of Your Finances

There you have it, folks. The Ally Financial Overnight Payoff Address is a powerful tool for anyone looking to pay off their loans quickly and efficiently. By understanding how it works and following the tips we’ve outlined, you can take control of your financial future.

Remember, knowledge is power. Stay informed, stay organized, and don’t hesitate to reach out for help when you need it. Whether you’re paying off a car loan or exploring new financial opportunities, Ally Financial has your back.

So, what are you waiting for? Take action today and start managing your finances with confidence. And don’t forget to share this article with anyone who might find it helpful!

![Ally Auto Overnight Payoff Address [FREE ACCESS]](https://overnightaddressfinder.com/wp-content/uploads/2024/04/Ally-Auto-Overnight-Payoff-Address.jpg)