Why State Farm Auto Insurance Is Your Smart Choice In 2023

Let’s be real here, folks—auto insurance ain’t just a formality anymore; it’s a necessity. Whether you’re cruising down the highway or stuck in rush-hour traffic, having the right coverage can save your wallet—and your peace of mind. And when it comes to trustworthy auto insurance, State Farm stands out like a shining star. With its rock-solid reputation, wide range of policies, and customer-first approach, State Farm has become a go-to choice for millions of drivers across the U.S. So, buckle up as we dive deep into why State Farm auto insurance might just be the perfect fit for you.

Nowadays, with so many insurance companies vying for your attention, choosing the right one can feel overwhelming. But here’s the deal: State Farm isn’t just another player in the game. This company has been around since 1922, and they’ve earned their stripes by consistently delivering top-notch service and reliable coverage. They’ve got the experience, the expertise, and the resources to back you up no matter what life throws at you.

From protecting your vehicle against accidents to covering damages caused by natural disasters, State Farm offers comprehensive plans tailored to meet your unique needs. Plus, their customer support team is always ready to lend a helping hand whenever you need it. Sounds pretty good, right? Let’s explore why State Farm should be on your radar if you’re in the market for auto insurance.

Read also:Brynn Woods Onlyfans Leak

Table of Contents:

- About State Farm Auto Insurance

- Coverage Options Tailored for You

- Pricing Plans That Fit Your Budget

- Exceptional Customer Service

- Discounts and Special Offers

- A Seamless Claims Process

- State Farm vs. Competitors

- Digital Tools and Mobile Apps

- Trust and Reliability

- Final Thoughts and Recommendations

About State Farm Auto Insurance

Before we get into the nitty-gritty details, let’s take a moment to understand who State Farm really is. Founded way back in 1922, State Farm started as a mutual insurance company focused on providing affordable and dependable coverage to American families. Fast forward to today, and they’ve grown into one of the largest insurance providers in the country, serving over 83 million policies worldwide.

What Makes State Farm Unique?

So, what sets State Farm apart from the rest? For starters, they offer more than just auto insurance. From home insurance to life insurance, State Farm has got you covered in almost every aspect of your financial protection needs. But their auto insurance division is where they truly shine.

- Wide network of agents: State Farm boasts the largest network of agents in the U.S., ensuring you’ll always find someone nearby to assist you.

- Local presence: Unlike some big-name competitors, State Farm operates through local agents who understand the specific needs of your community.

- Commitment to customer satisfaction: State Farm consistently ranks high in customer satisfaction surveys, proving that they genuinely care about their clients.

Coverage Options Tailored for You

One of the coolest things about State Farm is their flexibility in crafting coverage plans that match your lifestyle. Whether you drive an old clunker or a brand-new Tesla, they’ve got options to suit your budget and preferences.

Types of Coverage Offered

Here’s a quick rundown of the various coverage options available through State Farm:

- Liability Coverage: Protects you in case you’re found at fault in an accident.

- Collision Coverage: Covers damages to your vehicle resulting from a collision.

- Comprehensive Coverage: Provides protection against non-collision incidents like theft, vandalism, or weather-related damage.

- Roadside Assistance: Offers help in case of emergencies such as flat tires, lockouts, or dead batteries.

- Gap Insurance: Bridges the gap between your car’s value and the loan amount if your vehicle is totaled.

State Farm also allows you to customize your policy by adding endorsements like rental reimbursement or uninsured motorist protection. It’s all about finding the right mix of coverage to keep you safe and secure on the road.

Read also:Nala Fitness Leak

Pricing Plans That Fit Your Budget

We all know how important it is to stick to a budget, right? Luckily, State Farm offers competitive pricing without compromising on quality. Their rates are determined based on factors like your driving record, vehicle type, and location, but don’t worry—they also provide plenty of opportunities to save.

Factors Affecting Your Premium

Here’s a breakdown of the key elements that influence your State Farm auto insurance premium:

- Driving History: A clean record can lead to lower premiums, while traffic violations may increase your cost.

- Vehicle Type: Luxury cars or high-performance vehicles typically come with higher premiums.

- Location: Where you live plays a significant role in determining your rate, as urban areas tend to have higher risks.

- Coverage Level: Opting for basic liability coverage will generally cost less than comprehensive plans.

Remember, though, that while lower premiums sound great, it’s crucial to strike a balance between affordability and adequate coverage.

Exceptional Customer Service

Let’s face it—customer service can make or break an insurance company. Luckily, State Farm excels in this department. Their agents are trained to provide personalized assistance, whether you’re shopping for a new policy or filing a claim.

How State Farm Supports You

Here are some ways State Farm ensures you’re well taken care of:

- 24/7 Availability: Need help outside regular business hours? No problem! State Farm’s customer service team is available around the clock.

- Local Agent Support: Having a dedicated agent nearby makes it easier to address any questions or concerns you may have.

- Fast Claim Processing: State Farm prides itself on resolving claims quickly and efficiently, minimizing stress during tough times.

According to J.D. Power’s 2022 U.S. Auto Insurance Study, State Farm ranks among the top performers in customer satisfaction, which speaks volumes about their commitment to excellence.

Discounts and Special Offers

Who doesn’t love saving money? State Farm understands this and offers a variety of discounts to help you reduce your premium costs. From safe driver incentives to bundling multiple policies, there’s something for everyone.

Popular Discounts Available

Check out these awesome discounts offered by State Farm:

- Safe Driver Discount: Rewarding cautious drivers with reduced rates.

- Multi-Policy Discount: Save when you bundle auto insurance with other State Farm products.

- Good Student Discount: Encouraging academic excellence by offering breaks to students with good grades.

- Military Discount: Honoring service members and veterans with special pricing.

Keep in mind that eligibility for these discounts may vary depending on your circumstances, so be sure to ask your agent for details.

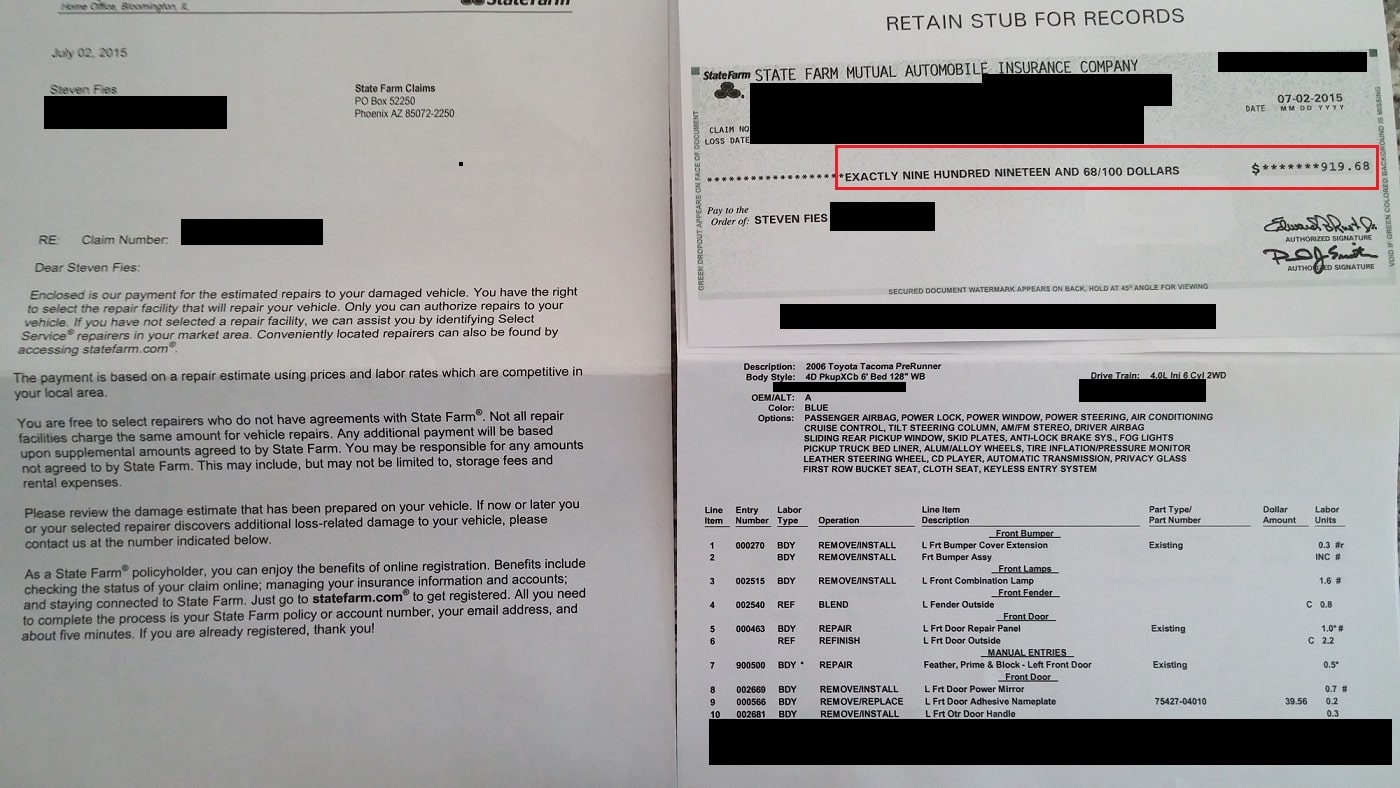

A Seamless Claims Process

Filing a claim shouldn’t feel like pulling teeth, and State Farm knows it. Their claims process is designed to be smooth and hassle-free, ensuring you receive the compensation you deserve without unnecessary delays.

Steps to File a Claim

Here’s how you can file a claim with State Farm:

- Contact your agent or call State Farm’s claims hotline.

- Provide necessary documentation, such as police reports or repair estimates.

- Wait for a claims adjuster to assess the situation and determine the payout amount.

State Farm’s mobile app even allows you to submit claims directly from your phone, making the entire process faster and more convenient.

State Farm vs. Competitors

Of course, State Farm isn’t the only game in town. But how does it stack up against other major players in the auto insurance industry? Let’s compare it to some of its biggest rivals.

Key Differences

Compared to competitors like Geico and Progressive, State Farm often stands out in the following areas:

- Largest Agent Network: More locations mean easier access to assistance.

- Strong Customer Satisfaction Ratings: Consistently high marks in surveys reflect their dedication to quality service.

- Comprehensive Coverage Options: Offering a wider array of policy types and add-ons.

While other companies may offer lower initial quotes, State Farm’s focus on long-term value and reliability often tips the scales in their favor.

Digital Tools and Mobile Apps

In today’s tech-savvy world, having access to digital tools is essential. State Farm gets this and has invested heavily in creating user-friendly platforms to enhance your experience.

State Farm Mobile App Features

Some of the standout features of the State Farm mobile app include:

- Policy Management: View and update your policy details on the go.

- Claims Submission: File claims instantly with just a few taps.

- Safe Driving Tools: Track your driving habits and earn rewards for safe behavior.

With the State Farm app, you’ll never have to worry about being disconnected from your insurance coverage.

Trust and Reliability

When it comes to auto insurance, trust is everything. State Farm has built a legacy of reliability that spans nearly a century, giving customers the confidence they need to choose them over competitors.

Why Choose State Farm?

Here’s why so many people trust State Farm:

- Long History of Service: Decades of experience in the industry.

- Financial Stability: Rated highly by major credit agencies for their solvency.

- Community Involvement: Actively participates in charitable initiatives and community programs.

State Farm’s commitment to excellence and integrity makes them a brand you can count on, rain or shine.

Final Thoughts and Recommendations

Alright, folks, that wraps up our deep dive into State Farm auto insurance. As you’ve seen, State Farm offers a winning combination of affordability, flexibility, and reliability that’s hard to beat. Whether you’re a seasoned driver or just starting out, they’ve got the tools and resources to keep you protected on the road.

So, what’s next? If you haven’t already, take a few minutes to get a quote from State Farm and see how their offerings align with your needs. And don’t forget to share this article with friends or family who might benefit from the information—we’re all in this together!

Remember, choosing the right auto insurance isn’t just about saving money; it’s about securing peace of mind. With State Farm by your side, you’ll be ready to face whatever challenges the road throws your way. Drive safe, and keep on rollin’!