Virginia Department Of Taxation: Your Ultimate Guide To Taxes In The Old Dominion State

When it comes to taxes, understanding the ins and outs can feel like trying to solve a riddle wrapped in an enigma. But don’t sweat it! The Virginia Department of Taxation (VA. Dept. of Taxation) is here to help you navigate the complexities of state taxes. Whether you're a resident, business owner, or just someone curious about how the system works, this guide has got you covered.

Think of the VA. Dept. of Taxation as your go-to buddy for all things related to state taxes. It’s not just about filing forms—it’s about ensuring you’re compliant, informed, and ready to tackle any tax-related challenge that comes your way. So, buckle up because we’re diving deep into the world of taxes, one step at a time.

Now, before we get too far ahead of ourselves, let’s set the stage. Taxes might sound intimidating, but they’re simply the price we pay for living in a society that values infrastructure, education, healthcare, and more. The VA. Dept. of Taxation ensures that every dollar collected is used responsibly to benefit the people of Virginia. Let’s break it down!

Read also:Anna Carter Onlyfans Leak

Understanding the VA. Dept. of Taxation

First things first—what exactly is the VA. Dept. of Taxation? Well, it’s the state agency responsible for administering Virginia’s tax laws. From individual income tax to sales tax, this department handles it all. Their mission? To fairly collect taxes while providing taxpayers with the resources they need to stay compliant.

Here’s a quick rundown of what the VA. Dept. of Taxation does:

- Administers state tax laws and regulations

- Collects taxes from individuals and businesses

- Provides guidance and support to taxpayers

- Enforces tax compliance through audits and penalties

It’s kind of like having a personal tax advisor, except it’s a whole department dedicated to making sure everything runs smoothly.

Key Functions of the VA. Dept. of Taxation

The VA. Dept. of Taxation wears many hats, but here are some of its most important roles:

- Income Tax Management: Handles personal and corporate income taxes

- Sales Tax Oversight: Ensures businesses collect and remit sales tax correctly

- Property Tax Coordination: Works with local governments to manage property taxes

- Excise Tax Collection: Collects taxes on specific goods like fuel, alcohol, and tobacco

See? It’s not just about sending out tax forms—it’s about ensuring the entire tax system works efficiently for everyone.

How the VA. Dept. of Taxation Impacts You

Whether you realize it or not, the VA. Dept. of Taxation plays a big role in your daily life. From the moment you buy groceries to when you file your annual tax return, this department is there, making sure everything stays on track.

Read also:Onlyfans Leak Twitter

Here are a few ways the VA. Dept. of Taxation impacts you:

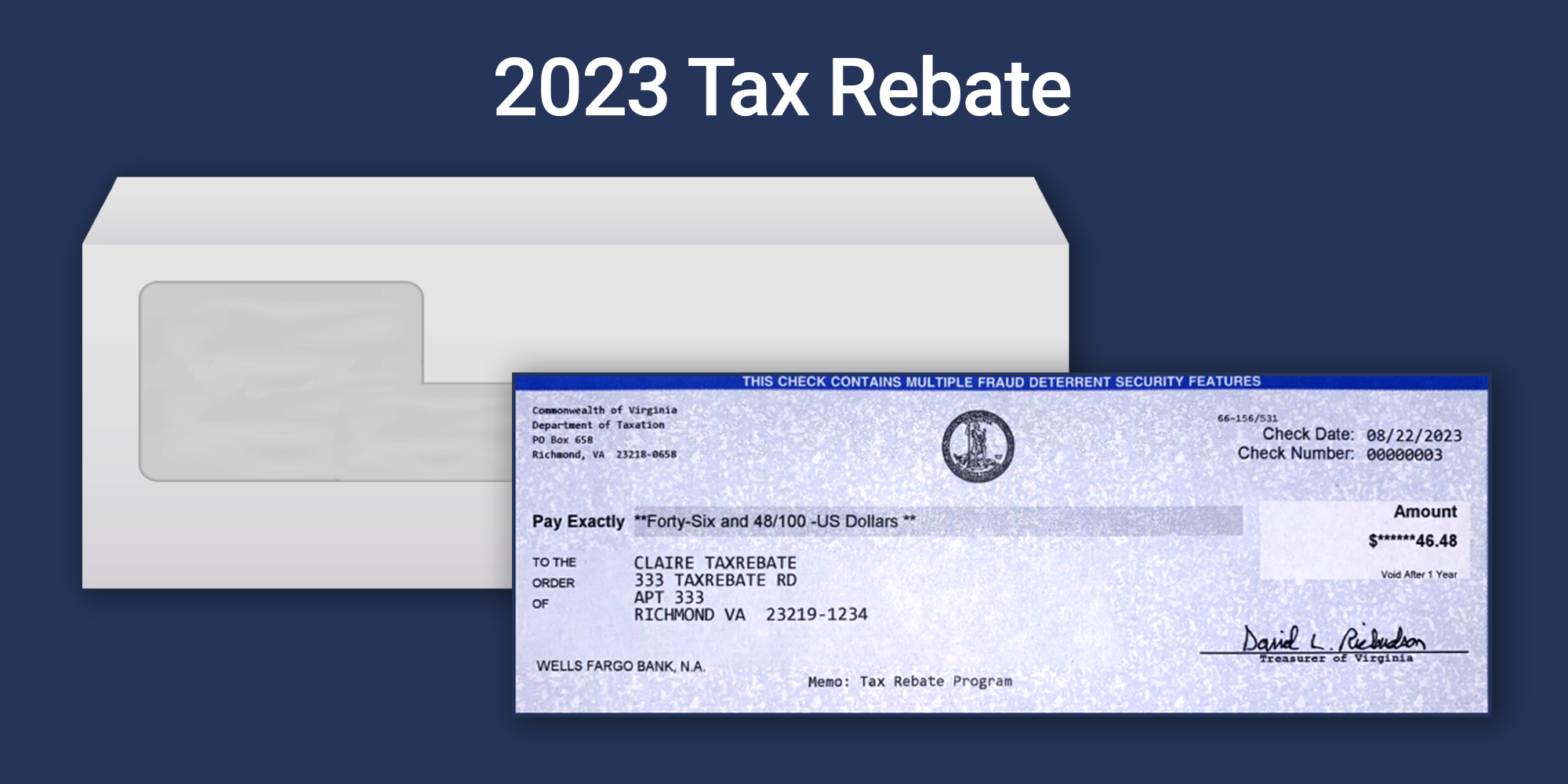

- Individual Tax Returns: Every year, you file your state income tax return with the VA. Dept. of Taxation. They determine if you owe money or if you’re eligible for a refund.

- Sales Tax Rates: The department sets the sales tax rate, which affects every purchase you make in Virginia.

- Business Taxes: If you own a business, the VA. Dept. of Taxation helps ensure you’re meeting all your tax obligations.

Basically, they’re the behind-the-scenes wizards keeping the tax world in check.

Common Taxpayer Questions

Got questions about taxes? You’re not alone. Here are some of the most common queries taxpayers have about the VA. Dept. of Taxation:

- When is the tax filing deadline?

- How do I check the status of my refund?

- What deductions can I claim on my state taxes?

- How do I appeal a tax decision?

The good news? The VA. Dept. of Taxation has resources to help you find answers to these and other questions.

History of the VA. Dept. of Taxation

Every great institution has a story, and the VA. Dept. of Taxation is no exception. Established to manage the state’s tax system, this department has evolved over the years to meet the changing needs of Virginians.

Back in the day, tax collection was a much simpler process. But as the population grew and the economy expanded, so did the complexity of the tax system. Today, the VA. Dept. of Taxation uses advanced technology and skilled professionals to ensure everything runs smoothly.

Fun fact: Did you know that Virginia was one of the first states to implement a sales tax? Yup, it’s been around for a while, and the VA. Dept. of Taxation has been at the forefront of managing it ever since.

Milestones in VA. Dept. of Taxation History

Let’s take a quick trip down memory lane:

- 1928: Virginia introduces its first sales tax

- 1970s: The department begins using computers to process tax returns

- 2000s: Online filing becomes available, revolutionizing the way taxpayers interact with the department

As you can see, the VA. Dept. of Taxation has come a long way. And they’re not stopping anytime soon!

Services Offered by the VA. Dept. of Taxation

What can the VA. Dept. of Taxation do for you? Plenty! Here’s a look at some of the services they offer:

- Online Filing: Submit your tax return electronically for faster processing

- Refund Status Tracking: Check the status of your refund online

- Taxpayer Assistance: Get help with questions or issues through their helpline or local offices

- Educational Resources: Access guides, webinars, and FAQs to better understand tax laws

It’s like having a personal assistant for all your tax needs—except it’s free!

How to File Your Taxes with the VA. Dept. of Taxation

Filing your taxes doesn’t have to be a headache. Here’s how you can do it with the VA. Dept. of Taxation:

- Gather all necessary documents, such as W-2s and 1099s

- Choose your filing method: online, by mail, or through a tax professional

- Complete the required forms, ensuring all information is accurate

- Submit your return by the deadline and keep a copy for your records

And just like that, you’re done!

Tax Credits and Deductions Available in Virginia

Who doesn’t love saving money? The VA. Dept. of Taxation offers several tax credits and deductions to help lighten the load for taxpayers. Here are a few examples:

- Virginia EIC: A credit for low- to moderate-income individuals and families

- Education Credits: Help reduce the cost of higher education expenses

- Energy Credits: Encourage the use of renewable energy sources

Be sure to check out all the available credits and deductions to make the most of your tax return.

How to Claim Tax Credits and Deductions

Claiming credits and deductions is easier than you think. Here’s how:

- Identify the credits and deductions you qualify for

- Gather any required documentation

- Include the appropriate forms with your tax return

- Double-check your calculations before submitting

It’s like finding hidden treasure in your tax return!

Tax Audits and Appeals

Let’s face it—no one likes the idea of a tax audit. But if you find yourself in that situation, the VA. Dept. of Taxation has procedures in place to ensure fairness.

Here’s what you need to know:

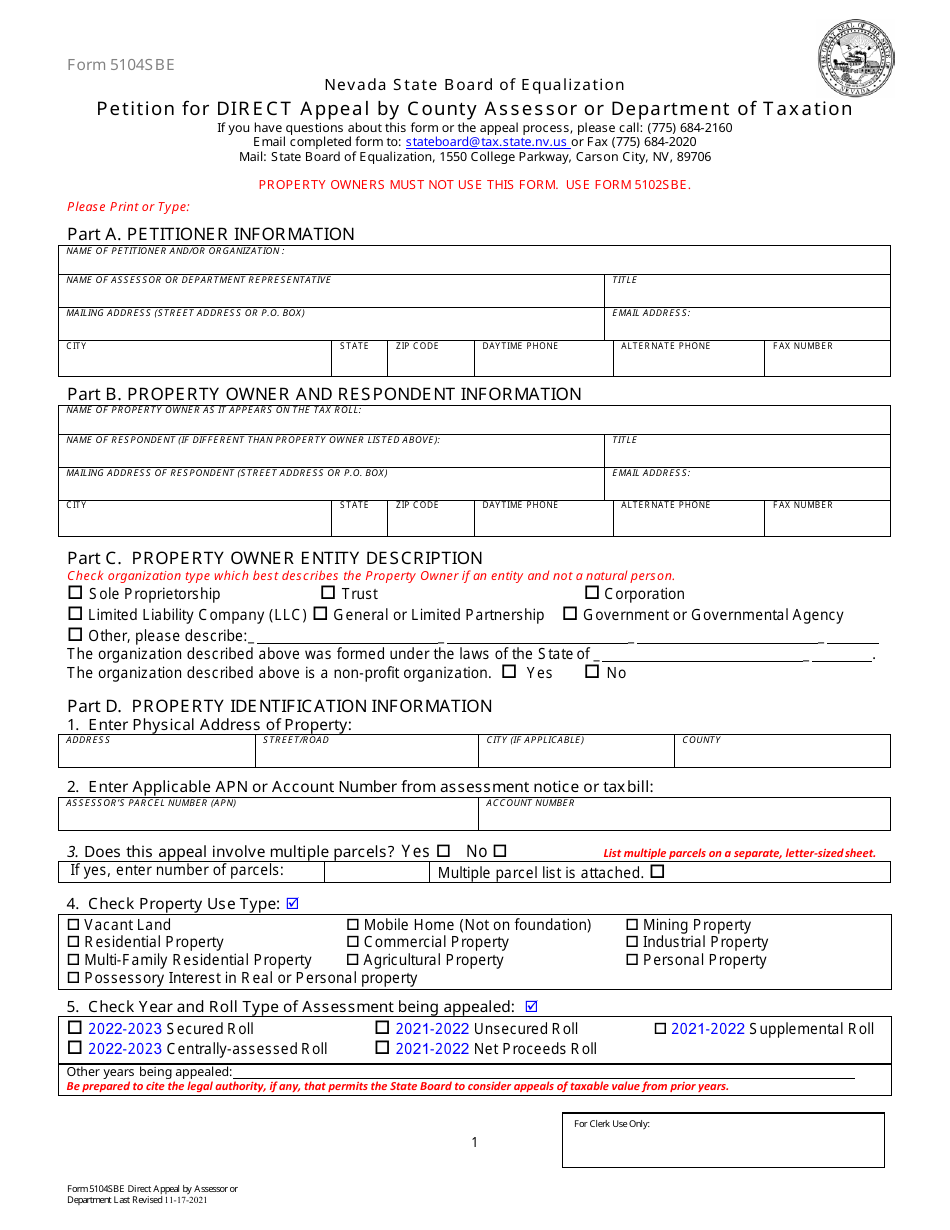

- Audit Process: If selected for an audit, the department will provide detailed instructions on what to expect

- Appeals Process: Disagree with a tax decision? You have the right to appeal and present your case

Remember, staying organized and keeping good records can make the audit process much smoother.

Preparing for a Tax Audit

If you’re facing an audit, don’t panic. Here’s how you can prepare:

- Review your tax return and gather all supporting documents

- Respond promptly to any communication from the VA. Dept. of Taxation

- Cooperate fully with the auditor and provide requested information

- Consider seeking professional assistance if needed

With the right approach, you can navigate the audit process with confidence.

Resources for Taxpayers

The VA. Dept. of Taxation offers a wealth of resources to help taxpayers stay informed and compliant. Here are a few you should check out:

- Website: Find forms, guides, and FAQs at their official site

- Helpline: Speak directly with a representative for personalized assistance

- Local Offices: Visit a nearby office for in-person support

These resources are there to help you every step of the way, so don’t hesitate to use them.

Tips for Staying Compliant

Staying compliant with tax laws doesn’t have to be complicated. Follow these tips:

- Keep detailed records of all income and expenses

- File your tax return on time every year

- Stay informed about changes in tax laws and regulations

- Seek professional advice if you’re unsure about anything

By following these simple steps, you can avoid headaches and ensure a smooth tax season.

Conclusion

And there you have it—an in-depth look at the Virginia Department of Taxation. From understanding their key functions to navigating the tax filing process, this guide has provided you with the tools you need to tackle taxes with confidence.

Remember, the VA. Dept. of Taxation is here to help. Whether you’re filing your return, claiming credits, or appealing a decision, they’re dedicated to ensuring fairness and compliance for all taxpayers.

So, what’s next? Take action! Whether it’s checking out their website, calling their helpline, or visiting a local office, now’s the time to get the information you need. And don’t forget to share this guide with others who might find it helpful. Together, we can make tax season a little less stressful.

Table of Contents

- Understanding the VA. Dept. of Taxation

- How the VA. Dept. of Taxation Impacts You

- History of the VA. Dept. of Taxation

- Services Offered by the VA. Dept. of Taxation

- Tax Credits and Deductions Available in Virginia

- Tax Audits and Appeals

- Resources for Taxpayers

Now go forth and conquer those taxes! You’ve got this!