Missouri Tax Revenue: The Complete Guide To Understanding The State's Financial Backbone

When it comes to Missouri tax revenue, the numbers don’t lie. The state relies heavily on taxes to fund essential services like education, healthcare, infrastructure, and public safety. But what exactly is Missouri tax revenue, and how does it impact everyday citizens? Well, buckle up because we’re diving deep into the world of taxes in the Show-Me State.

Imagine a giant piggy bank where all the money collected from taxes in Missouri gets stored. This piggy bank isn’t just for fun—it’s the lifeblood of the state’s economy. From building roads to supporting schools, every dollar counts. Understanding Missouri tax revenue isn’t just for accountants or politicians; it’s crucial for anyone who wants to know how their hard-earned money is being used.

Now, you might be thinking, “Why should I care about Missouri tax revenue?” Great question! It’s like asking why you should care about the air you breathe. Without proper funding, the state wouldn’t be able to provide the services we rely on daily. Whether you’re a business owner, a student, or a parent, understanding this system can help you make informed decisions. So, let’s break it down step by step.

Read also:Kayla Lauren Leak

What Is Missouri Tax Revenue?

Let’s get one thing straight: Missouri tax revenue refers to the total amount of money the state collects from various taxes. These taxes come in different forms, including sales tax, income tax, property tax, and more. Think of it as a giant jigsaw puzzle where each piece represents a different type of tax. When all the pieces come together, they form the big picture of how Missouri funds its operations.

For instance, sales tax is a big player in Missouri’s tax game. It’s the tax you pay when you buy stuff at the store or online. Income tax, on the other hand, is the money taken out of your paycheck. Property tax is what homeowners pay based on the value of their property. Each of these taxes contributes to the overall revenue pool, which is then allocated to different state programs and services.

How Missouri Tax Revenue Works

Here’s the deal: Missouri tax revenue doesn’t just magically appear. There’s a whole system in place to ensure that the state collects the right amount of money from the right people. This system involves laws, regulations, and government agencies working together to manage the process.

For example, the Missouri Department of Revenue is the main player in this game. They’re responsible for collecting taxes, enforcing tax laws, and making sure everything runs smoothly. It’s kind of like having a referee in a football game—without them, things could get chaotic real fast.

Key Players in Missouri Tax Revenue

Now, who are the key players in this whole tax revenue saga? Well, there’s the Missouri Department of Revenue, of course, but there are also other players like local governments, businesses, and individual taxpayers. Each group has a role to play in ensuring that the system works efficiently.

- Missouri Department of Revenue: The main agency responsible for tax collection.

- Local Governments: They handle property taxes and other local taxes.

- Businesses: They collect sales tax and pay corporate income tax.

- Individual Taxpayers: They pay income tax and sales tax.

The Importance of Missouri Tax Revenue

Missouri tax revenue isn’t just a bunch of numbers on a spreadsheet. It’s the backbone of the state’s economy. Without it, essential services like public schools, hospitals, and police departments wouldn’t exist. Think about it—how would you feel if your local school suddenly shut down because there wasn’t enough money to keep it running? Not so great, right?

Read also:Rouxrouxxx Onlyfans Leak

Moreover, tax revenue helps fund infrastructure projects like building roads and bridges. It also supports programs that help low-income families, provide healthcare for the uninsured, and protect the environment. In short, Missouri tax revenue is the glue that holds the state together.

Impact on Everyday Citizens

But how does Missouri tax revenue affect you, the everyday citizen? Well, it affects you in more ways than you might realize. For starters, the quality of public services you receive depends on how much tax revenue the state collects. If the state has a healthy revenue stream, you’re more likely to see well-maintained roads, top-notch schools, and efficient public transportation.

On the flip side, if tax revenue is low, the state might have to cut back on services or even raise taxes. This could mean higher property taxes, fewer teachers in schools, or longer wait times at the DMV. So, paying attention to Missouri tax revenue isn’t just about numbers—it’s about your quality of life.

Missouri Tax Revenue Sources

So, where exactly does Missouri get its tax revenue from? There are several sources, each playing a vital role in the state’s financial health. Let’s take a closer look at the main ones:

Sales Tax

Sales tax is one of the biggest contributors to Missouri tax revenue. It’s the tax you pay when you purchase goods or services. In Missouri, the state sales tax rate is 4.225%, but local governments can add their own rates on top of that. This means the total sales tax rate can vary depending on where you shop.

Income Tax

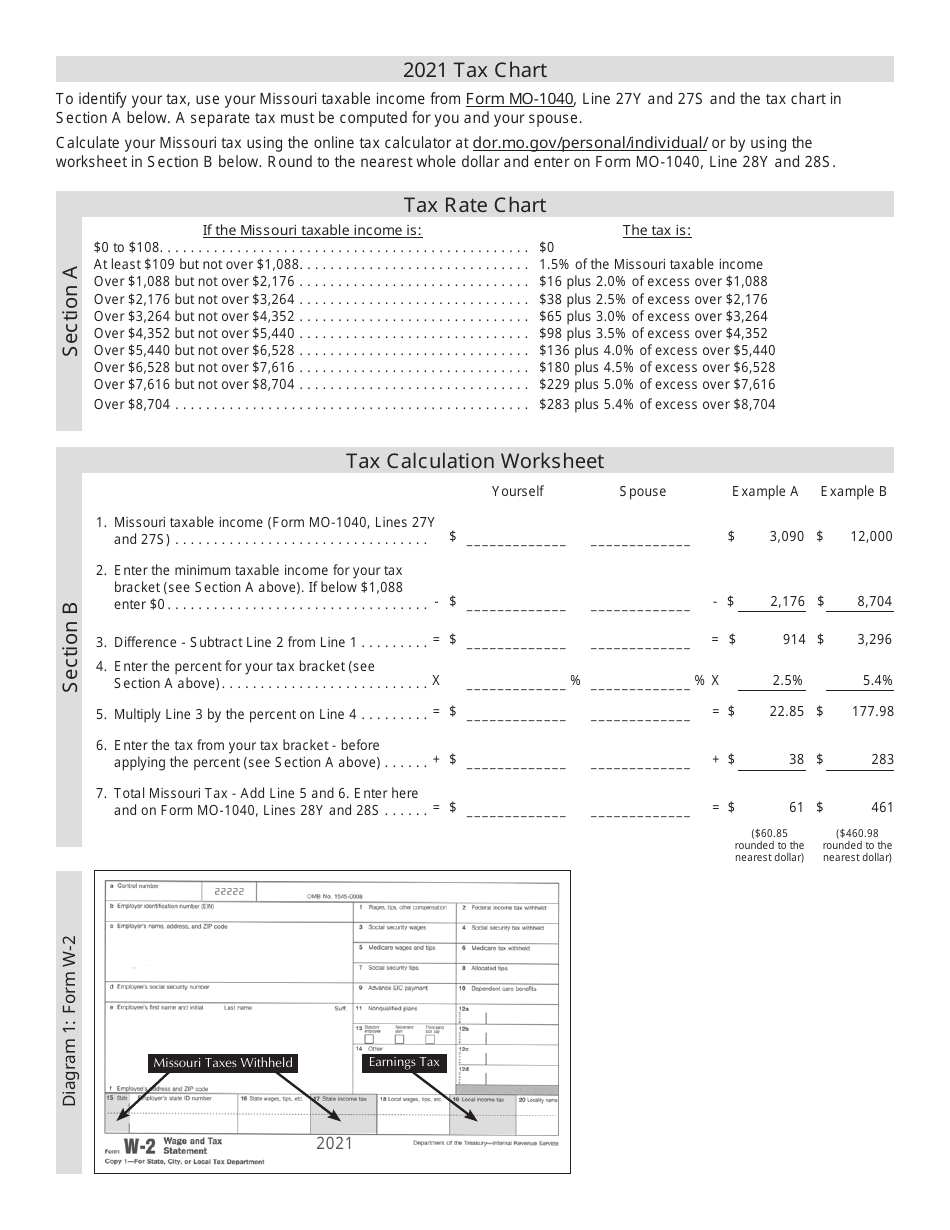

Income tax is another major source of revenue. In Missouri, the income tax rates range from 1.5% to 5.4% depending on how much you earn. The state uses a progressive tax system, meaning the more you earn, the higher your tax rate. This ensures that everyone contributes their fair share to the state’s coffers.

Property Tax

Property tax is the tax you pay on the value of your property. It’s calculated based on the assessed value of your home or land. Property tax is mainly used to fund local services like schools, libraries, and emergency services. While it’s not the largest source of revenue for the state, it’s still a significant contributor.

Challenges Facing Missouri Tax Revenue

No system is perfect, and Missouri tax revenue is no exception. There are several challenges that the state faces when it comes to collecting and managing tax revenue. Let’s explore some of these challenges:

Economic Downturns

One of the biggest challenges is economic downturns. When the economy takes a hit, people spend less money, which means less sales tax revenue. Businesses might also struggle, leading to lower corporate income tax. This can create a ripple effect, impacting the state’s ability to fund essential services.

Tax Evasion

Another challenge is tax evasion. Some individuals and businesses try to avoid paying their fair share of taxes, which can hurt the state’s revenue. The Missouri Department of Revenue works hard to detect and prevent tax evasion, but it’s an ongoing battle.

Changing Tax Laws

Finally, changing tax laws can also pose a challenge. As the state and federal governments update tax laws, it can be difficult for taxpayers to keep up. This can lead to confusion and errors, which can impact the accuracy of tax revenue collection.

How Missouri Uses Tax Revenue

Now that we’ve talked about where Missouri tax revenue comes from, let’s talk about how it’s used. The state allocates tax revenue to various programs and services, each designed to benefit the citizens of Missouri. Here are some of the main areas where tax revenue is spent:

Education

Education is one of the biggest beneficiaries of Missouri tax revenue. The state uses tax money to fund public schools, hire teachers, and provide resources for students. This ensures that every child in Missouri has access to a quality education.

Healthcare

Healthcare is another major area where tax revenue is spent. The state uses funds to support Medicaid programs, provide healthcare for the uninsured, and improve public health initiatives. This helps ensure that everyone in Missouri has access to necessary medical care.

Infrastructure

Infrastructure projects like building roads, bridges, and public transportation systems also rely on tax revenue. These projects are essential for economic growth and improving the quality of life for Missouri residents.

Future of Missouri Tax Revenue

Looking ahead, what does the future hold for Missouri tax revenue? With changing economic conditions and evolving tax laws, the state will need to adapt to ensure a steady revenue stream. Here are a few trends to watch:

Increasing Reliance on Sales Tax

As more people shop online, the state may need to increase its reliance on sales tax. This could involve updating tax laws to better capture revenue from e-commerce transactions.

Focus on Economic Growth

Encouraging economic growth is another way the state can boost tax revenue. By attracting new businesses and creating jobs, Missouri can increase its income tax and sales tax revenue.

Innovative Tax Solutions

Finally, the state may explore innovative tax solutions to address challenges like tax evasion and changing economic conditions. This could involve using technology to improve tax collection processes and make them more efficient.

Conclusion

Missouri tax revenue is a complex but essential part of the state’s financial system. From funding education and healthcare to building infrastructure, every dollar counts. Understanding how this system works can help you make informed decisions about your finances and advocate for policies that benefit you and your community.

So, what’s next? Take a moment to reflect on how Missouri tax revenue impacts your life. Share this article with friends and family to spread awareness. And don’t forget to stay informed about changes in tax laws and policies that could affect your wallet. Together, we can ensure a brighter financial future for all Missourians.

Table of Contents:

- What Is Missouri Tax Revenue?

- How Missouri Tax Revenue Works

- Key Players in Missouri Tax Revenue

- The Importance of Missouri Tax Revenue

- Impact on Everyday Citizens

- Missouri Tax Revenue Sources

- Challenges Facing Missouri Tax Revenue

- Economic Downturns

- Tax Evasion

- Changing Tax Laws

- How Missouri Uses Tax Revenue

- Future of Missouri Tax Revenue