How To Order A Checkbook From Chase: A Step-by-Step Guide

Ever found yourself scratching your head wondering how to order a checkbook from Chase? You're not alone, my friend. Whether you're a first-time Chase customer or just haven't ordered checks in a while, navigating the process can feel like solving a puzzle. But don’t sweat it! In this guide, we’ll break it down for you in simple terms, making sure you’re equipped with all the info you need to get your hands on those shiny new checks in no time.

Let's face it—checkbooks might not be as popular as they once were, but they're still super useful in certain situations. From paying rent to sending money to family, having a checkbook is like having a trusty sidekick in your financial journey. And Chase, being one of the biggest banks out there, makes the process easier than ever. So, buckle up because we’re about to dive deep into the world of Chase check ordering!

This article is designed to be your go-to resource for everything related to ordering a checkbook from Chase. We’ll cover everything from the basics to advanced tips, ensuring you’re not left in the dark. Plus, we’ll sprinkle in some fun facts and practical advice along the way. Let’s get started, shall we?

Read also:Shawty Bae Leak Video

Understanding the Basics of Chase Checkbooks

What Exactly Is a Checkbook?

Alright, let’s start with the basics. A checkbook is essentially a small booklet filled with pre-printed forms (checks) that allow you to make payments directly from your bank account. Each check has your account details printed on it, making it a secure and reliable way to transfer funds.

When it comes to Chase, their checkbooks are top-notch. They’re designed with security features to protect your account, and they come in various styles to suit your personal preferences. Whether you need personal checks or business checks, Chase has got you covered.

Why Order a Checkbook from Chase?

Here’s the deal: Chase is one of the most reputable banks in the game. By ordering your checkbook directly from them, you’re ensuring that everything is legit and secure. Plus, Chase offers a range of customization options, so you can personalize your checks to match your style.

- Security features to protect your account

- Customization options for personal and business checks

- Easy-to-use online ordering platform

- Fast delivery options

Step-by-Step Guide to Ordering a Checkbook from Chase

Method 1: Ordering Online

Ordering a checkbook online is probably the easiest and most convenient way to do it. All you need is access to your Chase account and a few minutes of your time. Here’s how you can do it:

- Log in to your Chase account through their website or mobile app.

- Click on the "Order Checks" option, usually found under the "Services" or "Account Settings" section.

- Select the type of checkbook you want (personal or business).

- Customize your checkbook if you wish to add special designs or messages.

- Review your order and confirm the details.

- Choose your delivery method and wait for your checkbook to arrive!

Pro tip: If you’re ordering online, make sure you’re using a secure connection. You don’t want any sneaky hackers getting their hands on your sensitive info.

Method 2: Ordering via Phone

Not a fan of doing things online? No worries! You can always order your checkbook by giving Chase a call. Here’s what you need to do:

Read also:Breckie Onlyfans Leak

- Grab your phone and dial Chase’s customer service number.

- Follow the prompts to reach the check ordering department.

- Provide your account details when prompted.

- Choose the type of checkbook you want and any customization options.

- Confirm your order and delivery details.

Calling in can sometimes be quicker if you have specific questions or need assistance with your order. Plus, it’s always nice to talk to a real person, right?

Customizing Your Chase Checkbook

Personalizing Your Checks

Let’s be honest—nobody wants a boring old checkbook. Chase lets you add a personal touch to your checks, making them unique to you. Whether you want to add a special message, choose a fun background design, or even add a photo, the possibilities are endless.

Here are some customization options you might want to consider:

- Adding your name and address in a custom font

- Selecting a background design that suits your style

- Including a motivational quote or personal message

- Upgrading to premium paper for a more luxurious feel

Remember, personalizing your checks not only makes them look cool but also adds an extra layer of security. If someone tries to forge your checks, they’ll have a harder time replicating your unique design.

Security Features of Chase Checkbooks

What Makes Chase Checks Secure?

Security is a big deal when it comes to checkbooks, and Chase doesn’t mess around. They incorporate several advanced security features into their checks to protect your account from fraud. Here are some of the features you can expect:

- Watermark technology to prevent counterfeiting

- Special ink that changes color when exposed to heat or light

- Microprinting that’s difficult to replicate

- Security fibers embedded in the paper

These features make it nearly impossible for anyone to forge your checks, giving you peace of mind every time you write one.

Common Questions About Ordering Checks from Chase

How Long Does It Take to Receive My Checkbook?

Delivery times can vary depending on your location and the delivery method you choose. Typically, standard shipping takes around 7-10 business days, while expedited shipping can get your checkbook to you in as little as 2-3 days. If you’re in a rush, make sure to select the fastest shipping option available.

Can I Order Checks for Free?

While Chase doesn’t offer completely free checkbooks, they do provide discounts and promotions from time to time. Keep an eye out for special offers or check with your local branch to see if you qualify for any deals. Plus, if you’re a long-time customer, you might be eligible for additional perks.

Tips for Managing Your Chase Checkbook

Keeping Track of Your Checks

Once you’ve got your shiny new checkbook in hand, it’s important to keep track of your checks to avoid any unwanted surprises. Here are a few tips to help you manage your checkbook effectively:

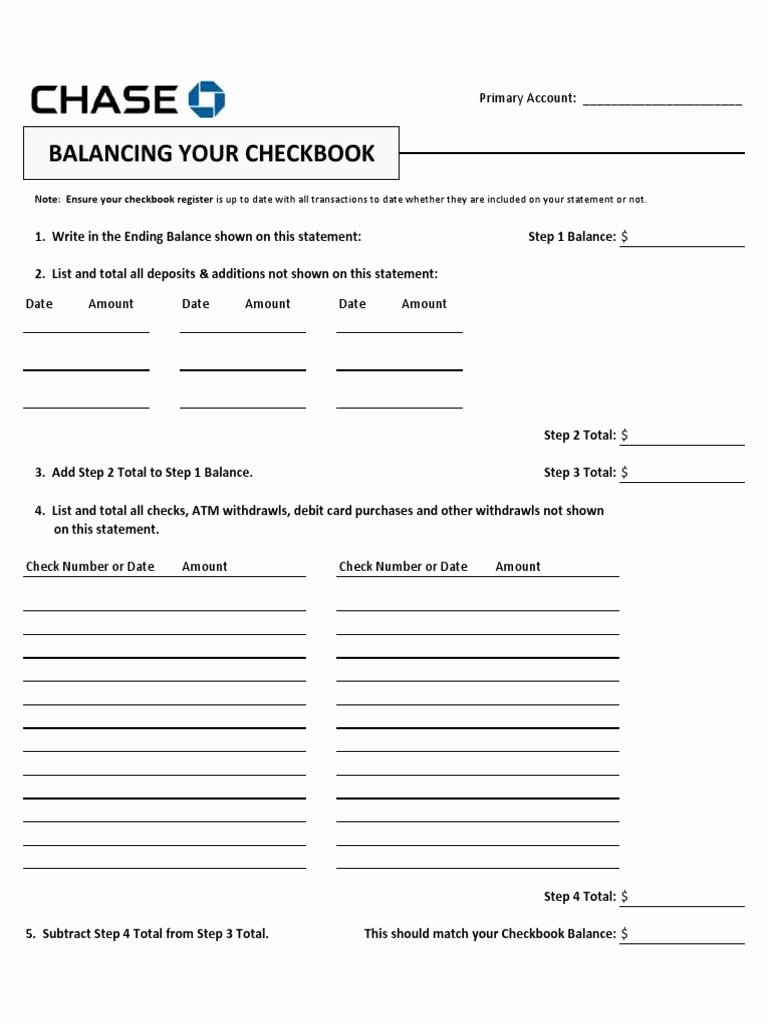

- Record each check in your check register as soon as you write it.

- Double-check the amount before signing the check.

- Store your checkbook in a safe and secure place when not in use.

- Regularly review your bank statements to ensure all checks have cleared.

By following these tips, you’ll be able to stay on top of your finances and avoid any potential issues down the line.

Alternatives to Chase Checkbooks

Third-Party Check Printing Services

While ordering directly from Chase is usually the best option, there are third-party check printing services you can consider if you’re looking for more variety or lower prices. However, be cautious when choosing a third-party service. Make sure they’re reputable and offer the same level of security as Chase.

Some popular third-party options include Checks Unlimited, CheckAdvantage, and Deluxe. These companies often provide a wider range of customization options and competitive pricing, but always read the fine print before placing your order.

Conclusion: Your Go-To Guide for Ordering Checks from Chase

So there you have it, folks! Ordering a checkbook from Chase is easier than you might think. Whether you choose to do it online, over the phone, or even in person, Chase makes the process smooth and hassle-free. Plus, with all the customization options and top-notch security features, you can rest assured that your checkbook will be both stylish and secure.

Now that you know how to order a checkbook from Chase, it’s time to take action. Whether you’re ordering for the first time or just need a refill, don’t hesitate to get started. And remember, if you have any questions or run into issues, Chase’s customer service team is always there to help.

So, what are you waiting for? Head over to Chase’s website or give them a call today and get your checkbook game on point!

Table of Contents

- Understanding the Basics of Chase Checkbooks

- Method 1: Ordering Online

- Method 2: Ordering via Phone

- Customizing Your Chase Checkbook

- Security Features of Chase Checkbooks

- Common Questions About Ordering Checks from Chase

- Tips for Managing Your Chase Checkbook

- Alternatives to Chase Checkbooks

- Conclusion