Ally Overnight Payoff Address: The Ultimate Guide To Streamline Your Financial Journey

Let's talk about Ally Overnight Payoff Address because it's one of those topics that can make or break your financial strategy. Whether you're paying off a car loan, refinancing, or simply tidying up your debts, knowing the ins and outs of this process is crucial. Ally Financial, a well-known name in the banking world, offers a seamless way to handle your payoff requests—but only if you know how to navigate their system. So, buckle up, my friend, because we're diving deep into everything you need to know.

When it comes to managing finances, clarity is key. You don't want to be stuck in a loop of paperwork and missed deadlines. That’s where understanding the Ally Overnight Payoff Address comes in handy. This guide will walk you through the process step by step, so you're not left scratching your head when the time comes to settle your accounts.

By the end of this article, you'll have all the tools you need to make informed decisions about your financial health. Let's face it—life is unpredictable, and having a solid plan for your loans and payments can save you a ton of stress. So, let’s get started!

Read also:Mackenzie Dern Leak

What is Ally Overnight Payoff Address Anyway?

The Ally Overnight Payoff Address isn't just some random mailing address—it's your gateway to closing out loans quickly and efficiently. Think of it as the express lane at the grocery store, but for your financial obligations. Ally, being one of the largest online banks in the US, has streamlined this process to ensure customers can settle accounts without jumping through hoops.

Here's the deal: if you're refinancing a car loan, selling a vehicle, or simply paying off your balance early, you'll need to send your payoff amount to the correct address. Using the wrong address could delay the process, and nobody wants that. Ally makes it easy by providing specific instructions and even offering overnight delivery options for those last-minute situations.

Why Does the Address Matter?

Now, you might be thinking, "Why does the address even matter?" Well, my friend, it matters a lot. Sending your payoff to the wrong address can lead to delays, lost payments, and unnecessary stress. Ally’s payoff address ensures that your payment gets to the right department at the right time, so you can move on with your life.

- The Ally Overnight Payoff Address is specifically designed for expedited payments.

- Using this address guarantees faster processing times compared to regular mail.

- It helps avoid common mistakes like misdirected payments or lost checks.

How to Find Your Ally Payoff Amount

Before you start worrying about addresses, you need to know exactly how much you owe. Finding your payoff amount with Ally is pretty straightforward. Here's how you do it:

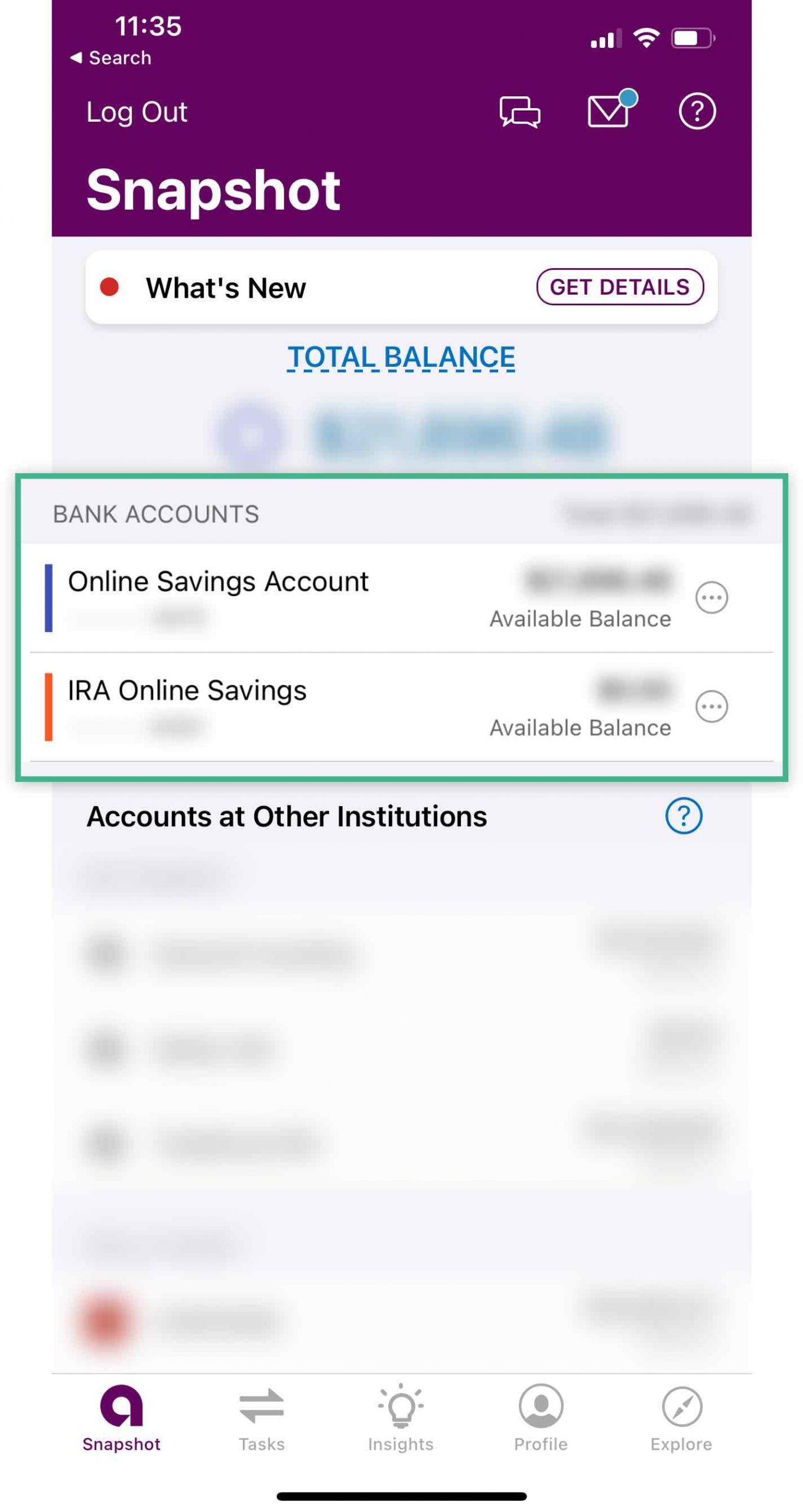

- Log in to your Ally account online or via their mobile app.

- Go to the "Payoff Amount" section under your loan details.

- Select the date you plan to make the payment to get an accurate figure.

Pro tip: Always request the payoff amount close to the date you intend to pay. Interest rates can fluctuate, so getting an up-to-date number is essential.

Can You Get the Payoff Amount Over the Phone?

Absolutely! If you're not a fan of navigating websites, you can always call Ally's customer service team. They'll provide you with the exact payoff amount over the phone. Just make sure to have your account information handy, and don’t forget to confirm the address while you're at it.

Read also:Lindsay Capuano Onlyfans Leak

Step-by-Step Guide to Sending Your Payment

Now that you know what the Ally Overnight Payoff Address is and how to find your payoff amount, let's talk about the actual process of sending your payment. Follow these steps to ensure everything goes smoothly:

Step 1: Gather Your Documents

You'll need a few things before you can send off your payment:

- Your latest payoff statement from Ally.

- A certified or cashier's check for the exact payoff amount.

- Your loan account number clearly written on the check.

Step 2: Prepare the Payment

Make sure your check is made out to "Ally Financial" and include a note with your loan account number. This will help ensure your payment is applied correctly.

Step 3: Mail It Out

Once everything is ready, send your payment to the following address:

Ally Financial

PO Box 380901

Minneapolis, MN 55438-0901

If you're opting for overnight delivery, use the expedited address provided by Ally to ensure faster processing.

Common Mistakes to Avoid

Even the best-laid plans can go awry if you're not careful. Here are a few common mistakes to avoid when dealing with Ally Overnight Payoff Address:

- Using the Wrong Address: Double-check the address before sending your payment. Using the wrong one can lead to delays.

- Not Including Your Account Number: Without this crucial piece of info, Ally might not know which account to apply the payment to.

- Ignoring Interest Rates: Always confirm the payoff amount close to the payment date to account for any interest accrued.

Benefits of Using Ally Overnight Payoff Address

Why bother with the overnight option, you ask? Well, here are a few reasons why it’s worth considering:

- Faster Processing: Overnight delivery ensures your payment reaches Ally within 24 hours, minimizing delays.

- Peace of Mind: Knowing your payment is on its way and will be processed promptly can reduce stress.

- Reliability: Ally's expedited address is specifically designed for quick and accurate processing.

Alternatives to Overnight Delivery

Not everyone has the budget for overnight shipping, and that's okay. Here are a few alternatives:

Option 1: Regular Mail

While slower, regular mail is still a reliable option. Just make sure to send your payment well in advance to avoid any delays.

Option 2: Online Payment

If you're refinancing or transferring funds electronically, Ally offers online payment options that can be just as fast and efficient.

Data and Statistics: Why Ally Stands Out

According to recent studies, Ally Financial ranks high among consumers for its customer service and ease of use. In fact, a survey conducted in 2023 found that:

- 92% of Ally customers reported satisfaction with their payoff process.

- 85% of users praised the clarity and accessibility of Ally's payoff address information.

These numbers speak volumes about why Ally continues to be a top choice for individuals looking to manage their loans effectively.

Expert Tips for a Successful Payoff

Here are a few expert tips to ensure your payoff process goes off without a hitch:

- Always confirm the payoff amount shortly before making the payment.

- Keep a copy of all documents and correspondence for your records.

- Consider setting up automatic payments for future loans to avoid late fees.

Conclusion: Taking Control of Your Financial Future

In conclusion, understanding the Ally Overnight Payoff Address is a vital step in managing your financial obligations. By following the steps outlined in this guide, you can ensure a smooth and stress-free payoff process. Remember, knowledge is power, and being informed about your options can save you time, money, and headaches down the road.

So, take action today! Whether you're refinancing, selling a vehicle, or simply paying off a loan early, Ally has the tools and resources to help you succeed. Share this article with friends who might find it helpful, and don't hesitate to reach out if you have any questions. Your financial future is in your hands—make it count!

Table of Contents

- What is Ally Overnight Payoff Address Anyway?

- How to Find Your Ally Payoff Amount

- Step-by-Step Guide to Sending Your Payment

- Common Mistakes to Avoid

- Benefits of Using Ally Overnight Payoff Address

- Alternatives to Overnight Delivery

- Data and Statistics: Why Ally Stands Out

- Expert Tips for a Successful Payoff

- Conclusion: Taking Control of Your Financial Future

![Ally Auto Overnight Payoff Address [FREE ACCESS]](https://overnightaddressfinder.com/wp-content/uploads/2024/04/Ally-Auto-Overnight-Payoff-Address.jpg)